Navigating Washington State’s Reimbursement Landscape: A Comprehensive Guide To Per Diem Rates In 2024

Navigating Washington State’s Reimbursement Landscape: A Comprehensive Guide to Per Diem Rates in 2024

Related Articles: Navigating Washington State’s Reimbursement Landscape: A Comprehensive Guide to Per Diem Rates in 2024

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Washington State’s Reimbursement Landscape: A Comprehensive Guide to Per Diem Rates in 2024. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Washington State’s Reimbursement Landscape: A Comprehensive Guide to Per Diem Rates in 2024

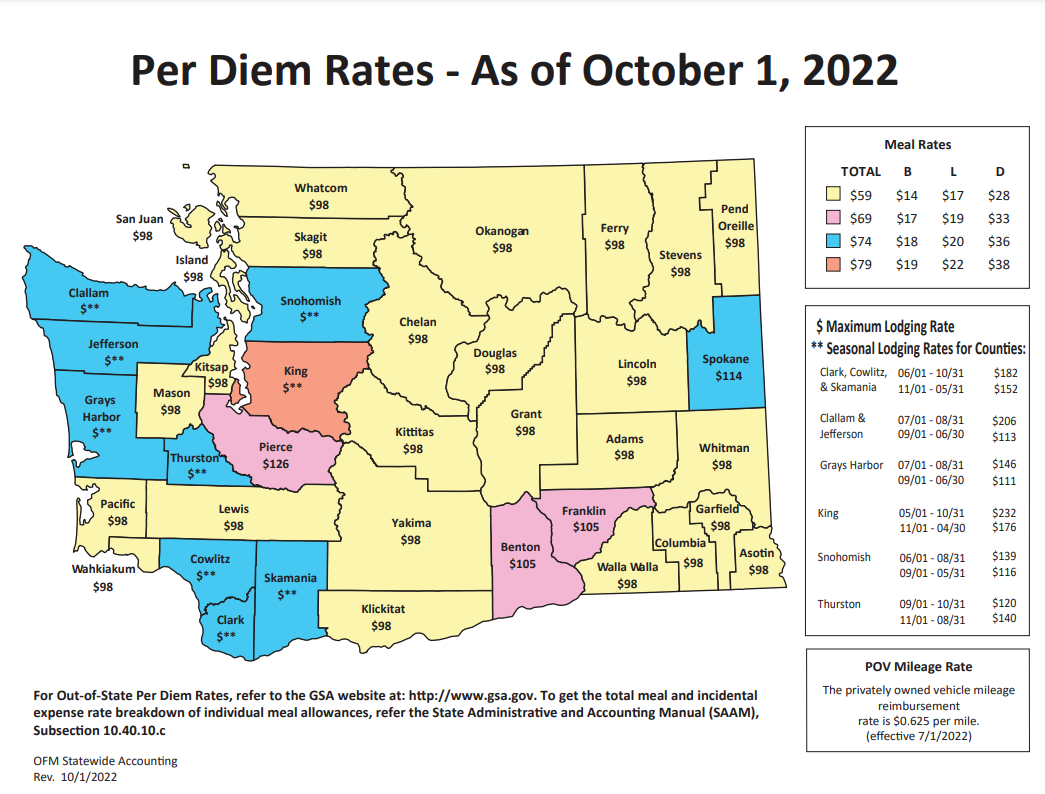

The Washington State Per Diem Map, updated annually, serves as a vital tool for individuals and organizations navigating the complexities of reimbursement for travel expenses. This map, developed by the Washington State Department of Enterprise Services (DES), provides a clear and concise framework for determining appropriate per diem rates for various locations across the state. Understanding the nuances of this map is crucial for ensuring accurate and compliant reimbursement practices.

Understanding Per Diem Rates: A Foundation for Accurate Reimbursement

Per diem rates represent the daily allowance for travel expenses, encompassing lodging, meals, and incidental expenses. These rates are designed to cover the cost of necessary expenses incurred during business travel, eliminating the need for detailed expense reporting. The Washington State Per Diem Map outlines these rates for each county, offering a standardized approach to reimbursement.

The Key Components of the Washington State Per Diem Map

The map, available online and in downloadable format, provides a comprehensive overview of per diem rates categorized by:

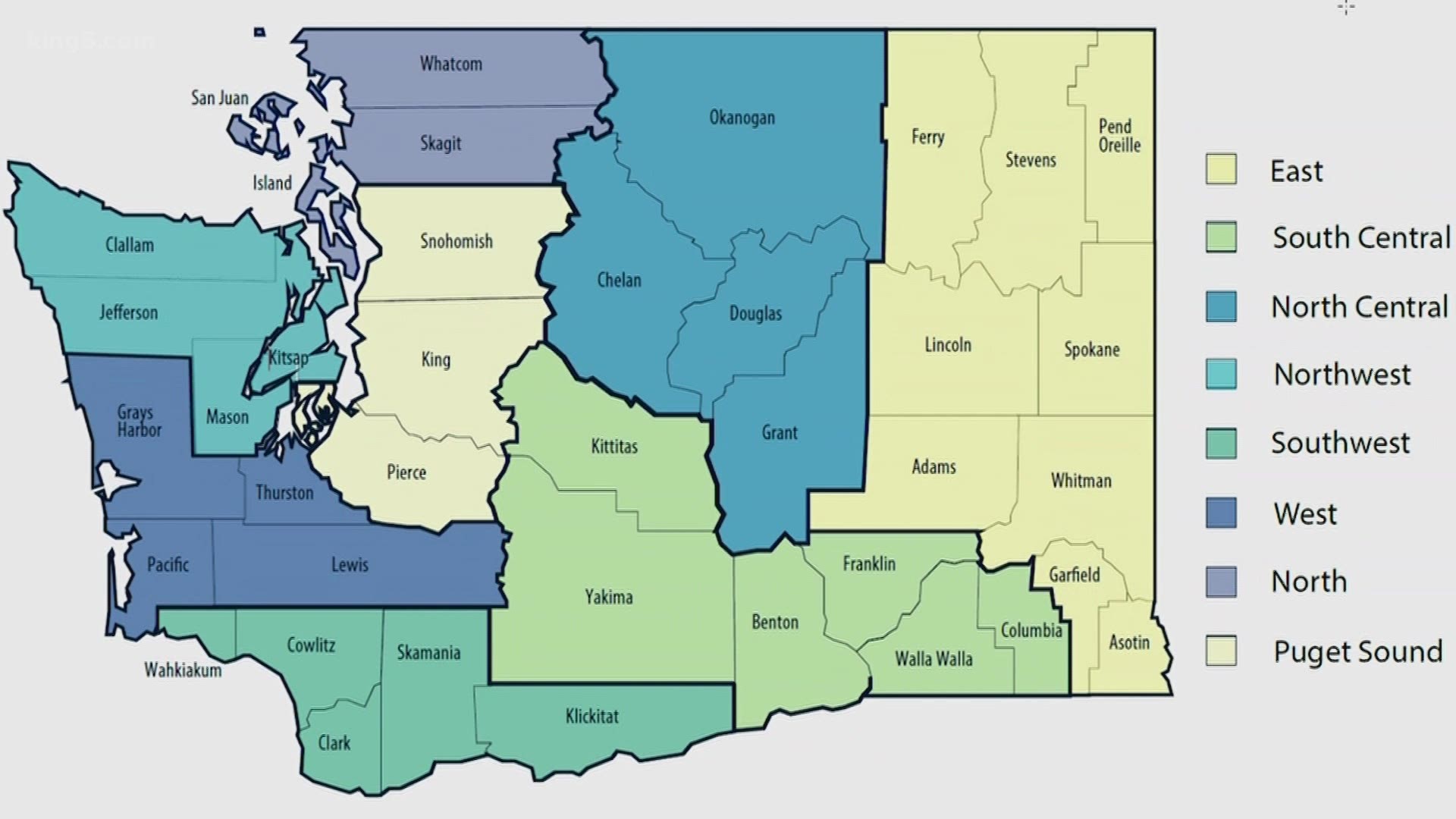

- County: The map is organized geographically, with each county in Washington State designated with a specific per diem rate.

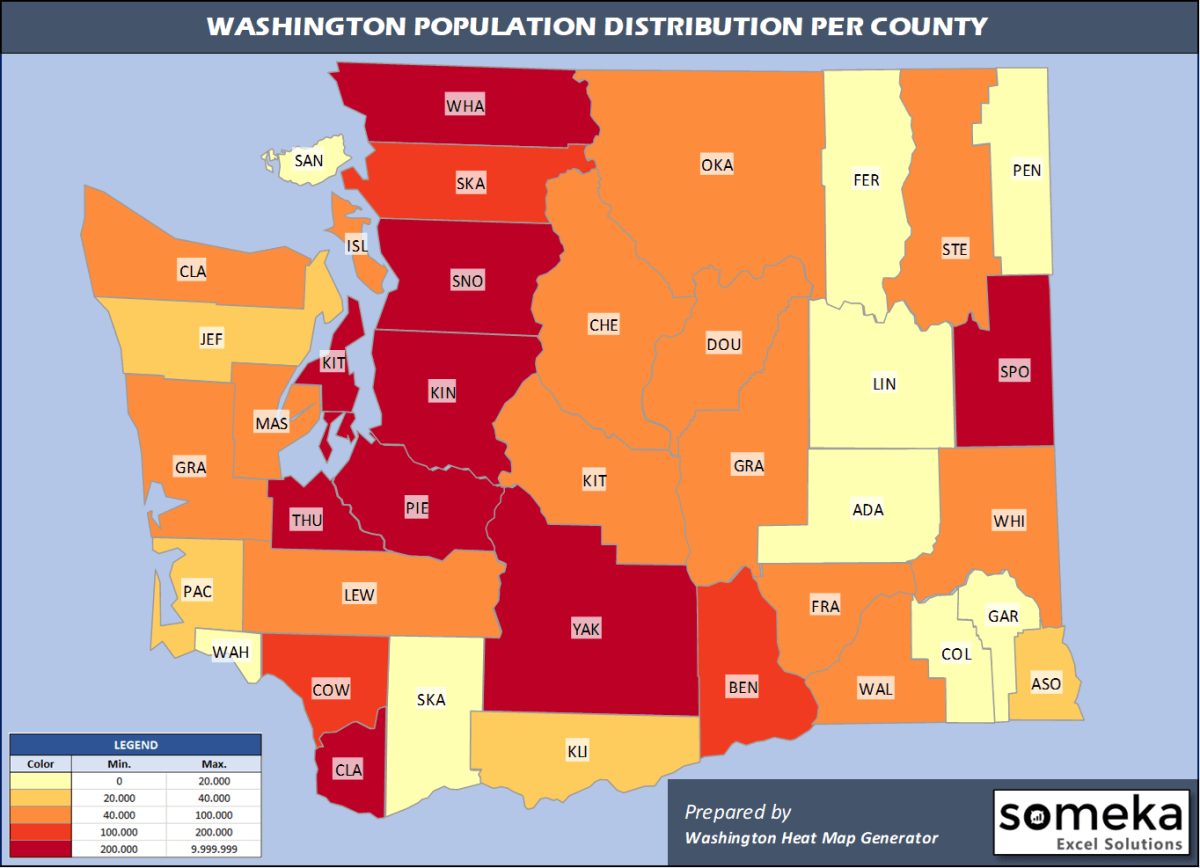

- Rate: The map specifies the daily per diem allowance for each county, taking into account local cost of living factors.

- Effective Date: The map indicates the effective date for each per diem rate, ensuring compliance with the latest updates and revisions.

Why the Washington State Per Diem Map Matters: Ensuring Compliance and Fairness

The map serves as a crucial reference point for:

- State Employees: State employees traveling on official business rely on the map to determine their allowable per diem expenses.

- Contractors: Contractors working for state agencies use the map to understand the reimbursement rates applicable to their travel within Washington State.

- Private Organizations: Private organizations, particularly those with contracts or collaborations with state agencies, often use the map as a benchmark for their own travel expense policies.

Navigating the Map: A Step-by-Step Guide

To effectively utilize the Washington State Per Diem Map, follow these steps:

- Identify the County: Determine the specific county where the travel will take place.

- Locate the Rate: Find the corresponding county on the map and identify the associated per diem rate.

- Check the Effective Date: Ensure that the per diem rate is current and applicable to the travel date.

- Apply the Rate: Use the per diem rate to calculate the total allowable reimbursement for the duration of the travel.

Beyond the Basics: Understanding the Per Diem Rate Structure

The Washington State Per Diem Map employs a standardized structure for per diem rates, incorporating two key components:

- Lodging: The lodging component covers the cost of overnight accommodations.

- Meals and Incidentals (M&IE): The M&IE component encompasses the cost of meals (breakfast, lunch, and dinner) and incidental expenses, such as laundry, dry cleaning, and tips.

Frequently Asked Questions (FAQs) Regarding the Washington State Per Diem Map

1. How are per diem rates determined?

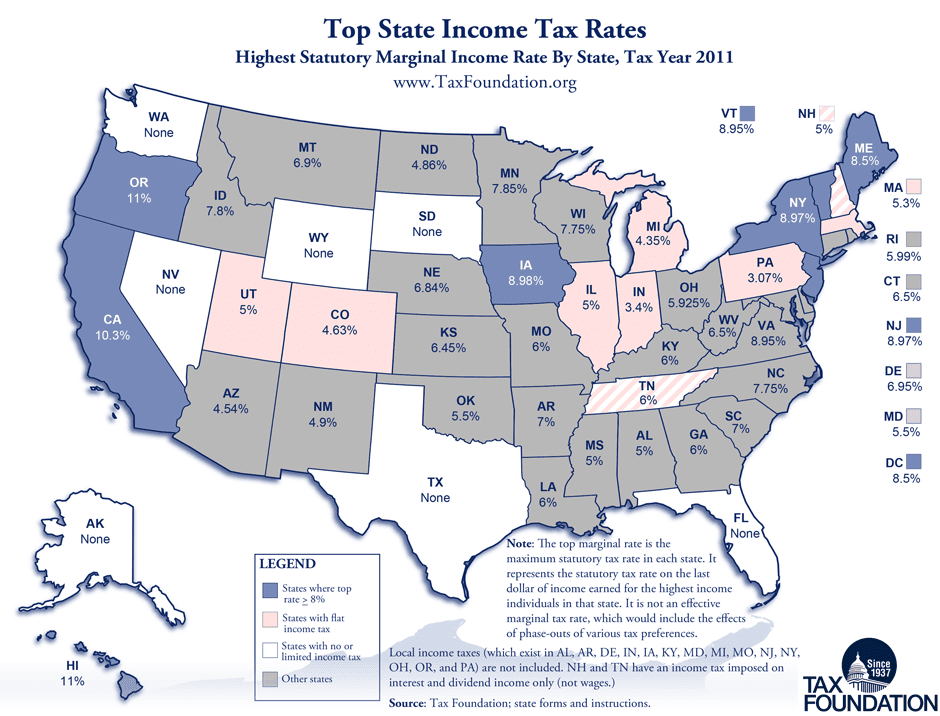

Per diem rates are calculated based on the U.S. Department of Homeland Security’s (DHS) Federal Travel Regulation (FTR) guidelines. These guidelines consider factors such as the cost of living in specific locations, historical data, and market research.

2. Are per diem rates subject to change?

Yes, per diem rates are periodically adjusted based on economic fluctuations and changes in the cost of living. The Washington State Per Diem Map is updated annually to reflect these changes.

3. What happens if my travel expenses exceed the per diem rate?

If your travel expenses exceed the per diem rate, you may be required to provide supporting documentation for the additional expenses. It’s crucial to consult with your employer or agency regarding their specific policies on exceeding per diem limits.

4. Can I use the Washington State Per Diem Map for travel outside of Washington State?

The Washington State Per Diem Map only applies to travel within Washington State. For travel to other states, consult the corresponding state’s per diem guidelines.

5. Are there any specific exceptions to the per diem rates?

While the map provides a standardized approach, certain exceptions may apply in specific situations. For example, individuals with disabilities may be eligible for additional expenses related to their accommodations. Consulting with your employer or agency is essential to understand any applicable exceptions.

Tips for Effective Per Diem Management

- Keep Accurate Records: Maintain detailed records of all travel expenses, including receipts and dates.

- Consult with Your Employer or Agency: Clarify your employer’s or agency’s specific policies regarding per diem reimbursements.

- Stay Updated: Regularly check the Washington State Per Diem Map for any updates or revisions to per diem rates.

- Seek Clarification: If you have any questions or uncertainties regarding per diem rates, contact the Washington State Department of Enterprise Services for guidance.

Conclusion: A Guide to Streamlined and Compliant Travel Reimbursements

The Washington State Per Diem Map serves as an invaluable resource for individuals and organizations seeking to navigate the complexities of travel expense reimbursement. By understanding the structure and application of per diem rates, individuals can ensure accurate and compliant reimbursement practices, fostering efficiency and transparency in the management of travel expenses. Staying informed about updates and utilizing the map effectively empowers individuals to navigate the reimbursement process with confidence and accuracy.

Closure

Thus, we hope this article has provided valuable insights into Navigating Washington State’s Reimbursement Landscape: A Comprehensive Guide to Per Diem Rates in 2024. We hope you find this article informative and beneficial. See you in our next article!