Delving Into The Washington County, New York Tax Map: A Comprehensive Guide

Delving into the Washington County, New York Tax Map: A Comprehensive Guide

Related Articles: Delving into the Washington County, New York Tax Map: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Delving into the Washington County, New York Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Delving into the Washington County, New York Tax Map: A Comprehensive Guide

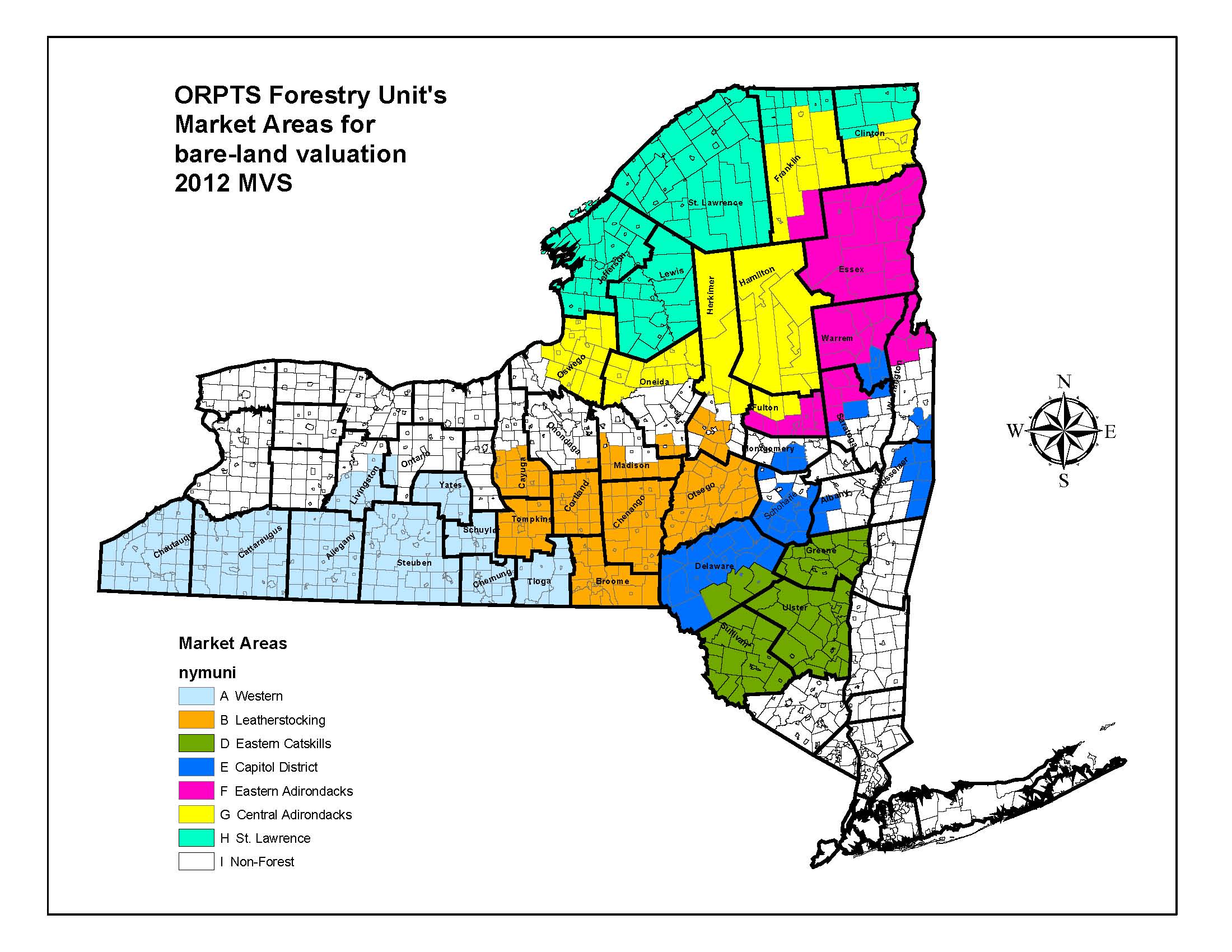

The Washington County, New York Tax Map serves as a vital tool for understanding and managing property within the county. This intricate system, constantly evolving to reflect changes in land ownership and use, provides a comprehensive overview of property boundaries, ownership, and assessments. This article explores the multifaceted nature of the Washington County Tax Map, its significance for various stakeholders, and its potential for future development.

Understanding the Structure and Purpose

The Washington County Tax Map is a geographically-based system that divides the county into individual parcels of land. Each parcel is assigned a unique identification number, known as the Tax Map Number (TMN), serving as a primary identifier for property records. The map itself is typically presented as a series of detailed maps, each covering a specific geographic area within the county.

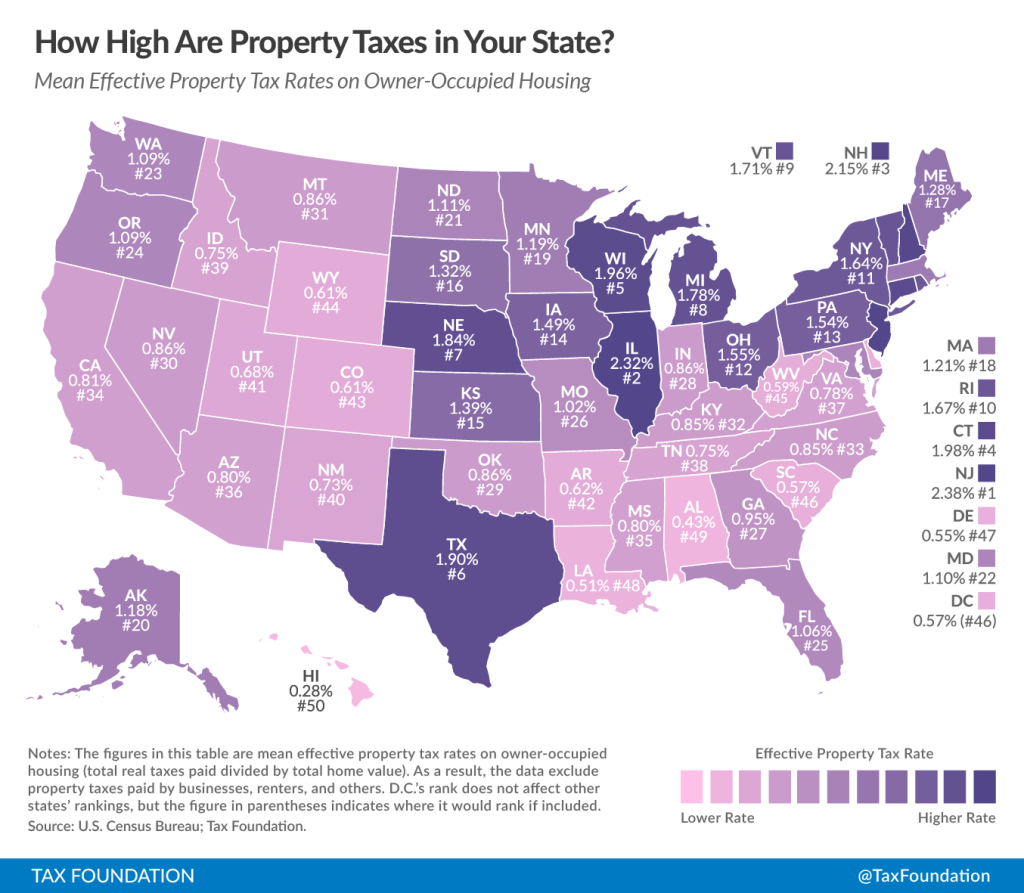

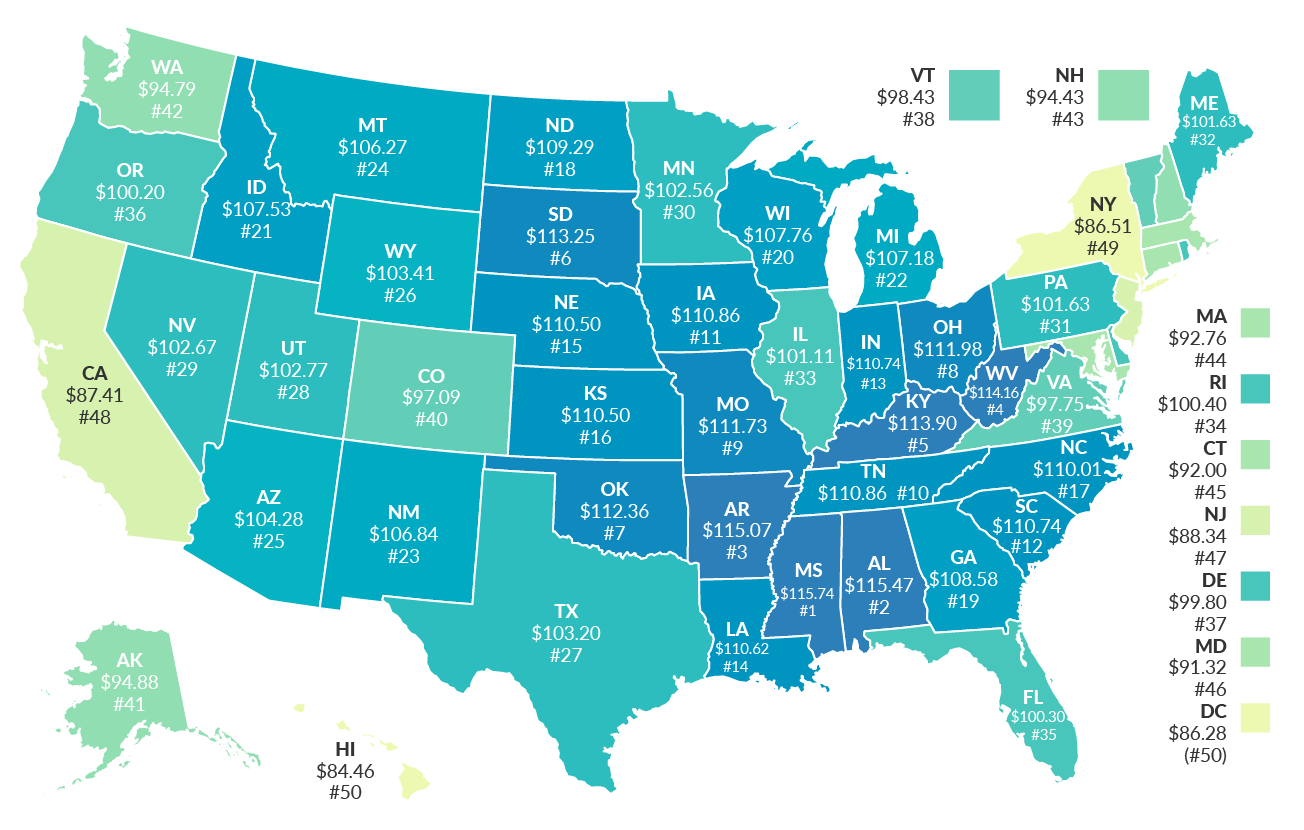

The core purpose of the Washington County Tax Map is to facilitate property tax administration. By providing a standardized method for identifying and locating properties, the map enables accurate assessment of property values and efficient collection of property taxes. This ensures fairness in the tax burden distribution across the county, as property owners are taxed based on the assessed value of their land and improvements.

Key Components and Information

The Washington County Tax Map encompasses various critical components that contribute to its comprehensive nature:

- Parcel Boundaries: Each map clearly delineates the boundaries of individual parcels, indicating the exact extent of land ownership.

- Property Ownership: The map identifies the current owner of each parcel, typically including their name and address.

- Assessment Data: The assessed value of each parcel is recorded on the map, reflecting the estimated market value of the property for tax purposes.

- Land Use Information: The map often indicates the primary land use for each parcel, whether it be residential, commercial, agricultural, or other categories.

- Topographical Features: Some maps incorporate topographical features such as elevation, waterways, and road networks, offering a more complete picture of the landscape.

Benefits for Various Stakeholders

The Washington County Tax Map offers numerous benefits to a wide range of stakeholders:

- Property Owners: The map provides clarity regarding property boundaries, ownership details, and assessed values, empowering property owners to understand their tax obligations and make informed decisions regarding their property.

- Tax Assessors: The map is a crucial tool for assessors in determining property values, ensuring equitable tax assessments across the county. It facilitates efficient and accurate property valuation processes, contributing to the overall fairness of the tax system.

- Real Estate Professionals: Real estate agents and brokers utilize the map to identify properties, understand their characteristics, and assess market values, aiding in their professional transactions.

- Government Agencies: The map is vital for various government agencies, including planning departments, environmental agencies, and emergency services. It provides a comprehensive understanding of land ownership, land use patterns, and infrastructure, supporting informed decision-making in various sectors.

- Public Access: The Washington County Tax Map is often available to the public, providing transparency and access to information about property ownership and assessments. This fosters accountability and encourages public participation in local government processes.

Navigating the Tax Map: Tools and Resources

Accessing and utilizing the Washington County Tax Map is facilitated by various resources and tools:

- Online Mapping Systems: Many counties, including Washington County, offer online mapping platforms that allow users to explore the tax map interactively, search for specific properties, and access detailed information.

- County Assessor’s Office: The Washington County Assessor’s Office serves as the primary source for accessing the tax map and related information. They provide physical copies, online resources, and personalized assistance to users.

- Geographic Information Systems (GIS): Advanced GIS software allows for sophisticated analysis and visualization of the tax map data, enabling users to explore complex relationships and patterns within the county’s land use and ownership.

FAQs about the Washington County Tax Map

1. How can I access the Washington County Tax Map?

The Washington County Tax Map can be accessed through the County Assessor’s Office website or by visiting the office in person. Many counties also offer online mapping platforms that provide interactive access to the map.

2. What information can I find on the Washington County Tax Map?

The tax map displays information about parcel boundaries, property ownership, assessed values, land use, and sometimes topographical features.

3. How can I find the Tax Map Number (TMN) for a specific property?

You can search for a specific property using the online mapping system or by contacting the County Assessor’s Office. They can assist you in identifying the TMN for a given address or property description.

4. How often is the Washington County Tax Map updated?

The tax map is typically updated annually to reflect changes in property ownership, land use, and assessed values.

5. What are the legal implications of the Washington County Tax Map?

The tax map is a legal document that provides a definitive record of property boundaries and ownership. It serves as a basis for property tax assessments and legal disputes related to land ownership.

Tips for Utilizing the Washington County Tax Map

- Familiarize yourself with the map’s structure and terminology. Understanding the key components and symbols will enhance your ability to navigate the map effectively.

- Utilize the online mapping system or GIS software for advanced search and analysis capabilities. These tools allow you to filter, zoom, and overlay data to gain deeper insights into the map’s information.

- Contact the County Assessor’s Office for assistance. Their staff can provide guidance on map interpretation, data retrieval, and specific property information.

- Stay informed about updates and changes to the tax map. Regularly check the County Assessor’s website or contact their office to ensure you have access to the most current version of the map.

Conclusion

The Washington County Tax Map is an essential tool for understanding and managing property within the county. Its comprehensive nature, accessibility, and ongoing updates make it a valuable resource for property owners, assessors, real estate professionals, government agencies, and the public at large. By leveraging the information and resources available through the tax map, stakeholders can make informed decisions, ensure fair tax administration, and contribute to the effective development and management of Washington County. As technology continues to evolve, the tax map is likely to become even more sophisticated, offering enhanced visualization, data analysis, and public access capabilities. This ongoing development will further solidify its role as a critical component of the county’s administrative and economic landscape.

Closure

Thus, we hope this article has provided valuable insights into Delving into the Washington County, New York Tax Map: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!